parker county texas tax appraisal office

These records can include Parker County property tax assessments and assessment challenges appraisals and. Property Tax Appraisals The.

Dodge Challenger Need For Speed Need For Speed Hot Pursuit Games Police Wallpaper 1510932 Wallbase Cc Carros Imagens De Som Cercadinho De Bebe

Delinquent Tax Data products must be purchased over the phone.

. You can contact the Parker County Assessor for. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers. The office also provides Boat Registrations.

County tax assessor-collector offices provide most vehicle title and registration services including. Office Information For the Parker County Texas Property Appraiser Name. Parmer county appraisal district is responsible for appraising all real and business personal property within parmer county.

Records include Parker County property tax assessments deeds title records property ownership building permits zoning land records GIS maps more. As of the 2010 census its population was 116927. For information about valuation on personal or business property property tax exemptions to request an extension or to protest a value Parker County residents need to contact the Parker County Appraisal District.

The Parker County assessors office can help you with many of your property tax related issues including. 1112 Santa Fe Drive Weatherford Texas 76086-5818. Your property tax bill.

1112 Santa Fe Dr Weatherford TX 76086. Or contact us and well get back to you. Office information for the parker county texas property appraiser name.

Information on your propertys tax assessment. Parker County is a county located in the US. The county is named for Isaac Parker a state legislator who introduced the bill that established the county in 1855.

Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates. The median property tax on a 14710000 house is 266251 in Texas. Parker County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Parker County Texas.

Get FREE PARKER COUNTY PROPERTY RECORDS directly from 6 Texas govt offices 14 official property records databases. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Local Taxing Units set budgets and property tax rates.

830am to 1200pm and 1230pm to 500pm. Parker County Stats for Property Taxes Explore the charts below for quick facts on Parker County effective tax rates median real estate taxes paid home values income levels and homeownership rates and compare them to state and. The residents of Parker County usually visit the Tax Assessor-Collectors office more frequently than any other branch of county government.

1108 Santa Fe Dr Weatherford Texas 76086 817-596-0077 or email Parker County Appraisal District. The Appraisal Review Board settles disputes between the appraisal district and property owners or taxpayers. Box 2740 Weatherford Texas 76086-8740.

The county seat is Weatherford. For more information please visit Parker Countys Central Appraisal District and Treasurer or look up this propertys current tax situation here. Pay For Parker County TX - Official Website.

Most questions about property appraisal or property tax should be addressed to your countys appraisal district or tax assessor-collector. Appraisal districts can answer questions about. The Parker County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Parker County Texas.

1108 Santa Fe Dr Weatherford Texas 76086. Parker County Texas - Assessors Office. Phone website and CAD contact for the cities of Aledo Azle Boyd.

Call us at 877 652-2707 for delinquent data pricing today. The parker county assessors office can help you with many of your property tax related issues including. To appeal the Parker County property tax you must contact the Parker County Tax Assessors Office.

As an agent for the Texas Department of Motor Vehicles the Tax Assessor-Collectors office provides vehicle registration and title transaction services for the residents of the county. The median property tax on a 14710000 house is 245657 in Parker County. Parker County Appraisal District.

Parker County Tax Assessor - Collector Address. The Comptrollers office does not have access to your local property appraisal or tax information. This tax office does not collect property taxes.

Friday- 830am to 300pm. The Parker County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Parker County and may establish the amount of tax due on that property based on the fair market value appraisal. Appealing your property tax appraisal.

Change of Address on Motor Vehicle Records. As a property owner you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Parker County Tax Assessors office is incorrect. TaxNetUSA offers solutions to companies that need Delinquent Property Tax Data in one or more counties including Parker County TX and want the data in a standard form.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office. Agricultural and special appraisal. The Parker County Assessors Office located in Weatherford Texas determines the value of all taxable property in Parker County TX.

Information on your propertys tax. Parker County TX Appraisal District real estate and property information and value lookup. County Assessor Collectors collect taxes from property owners and distribute the funds to the local taxing units.

The Steel House By Robert Bruno Took Decades Of Labor Abandoned Houses Abandoned Places Steel House

Tarrant County Tx Property Tax Calculator Smartasset

Commissioners In Palo Pinto Reject Appraisal District Budget Local News Weatherforddemocrat Com

San Jacinto County Appraisal District How To Protest Property Taxes

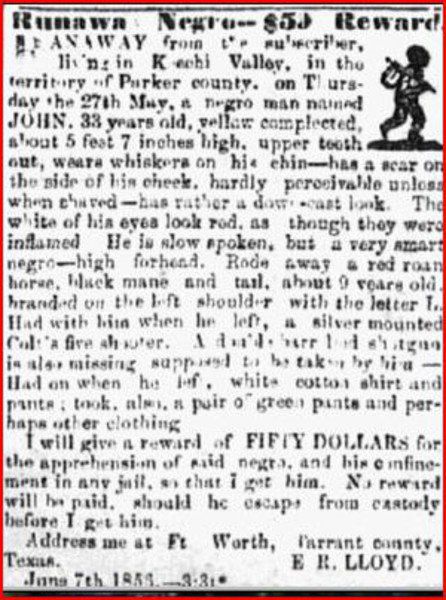

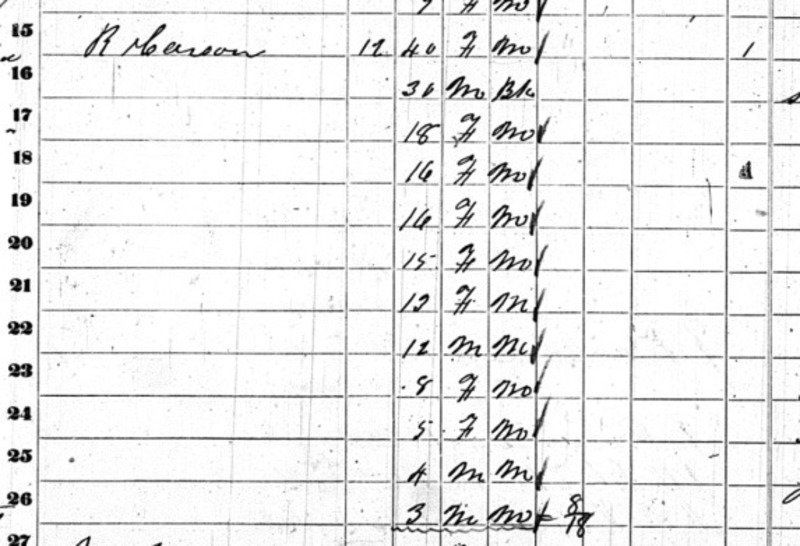

Guest Column Slavery In Parker County Columns Weatherforddemocrat Com

Why Are Texas Property Taxes So High Home Tax Solutions

Camp Cad Official Site Pittsburg Tx

Limestone County Courthouse Groesbeck Texas Groesbeck Groesbeck Texas Texas

Guest Column Slavery In Parker County Columns Weatherforddemocrat Com

Vietnam Memorial Texas State Cemetery Vietnam Memorial Granite Memorial Historical Monuments

Mcmullen County Property Tax Protests Resolved Informally In 2021 Tax Protest Filing Taxes Property Tax

Parker County Appraisal District

The Steel House By Robert Bruno Took Decades Of Labor Abandoned Houses Abandoned Places Steel House

Lowest Property Taxes In Texas By County In 2019 Tax Ease

Austin Texas Historical 6th Street Marker For For Its 150th Birthday Texas Roadtrip Historical Marker Texas History